What Is The Securities And Exchange Commission?

However the agency did not examine the billionaire until 2005, and also waited one more 4 years after that to sue him. Assessing all official company action from the viewpoint of the private financier, including conducting investor studies and also emphasis groups. The Office of Safety and security Solutions is in charge of operations connected to the safety, safety, and emergency management of all SEC centers as well as staff.

I have located the service that you give of wonderful high quality and also will definitely return in the future if I need to search for a setting once more. Private equity investing has grown considerably in the past two decades, as well as currently stands for a substantial section– 5 to 15 percent– of the profiles of lots of high web worth financiers and also establishments. This Internet site uses Cookies to improve its performance, provide performance, targeting and analytics. With his financial industry knowledge, deal experience and also background as a business owner, Tom creates innovative deals and also economic frameworks. and after that overviews his customers through the closing procedure. Todd holds a bachelor`s degree in organization marketing from Drake College as well as is associated with a number of charities, consisting of the March of Dimes and Victory Joint Camp.

Though the particular stipulations of these laws differed among states, they all required the registration of all securities offerings and also sales, in addition to of every U.S. financier and also broker agent firm. As an example, as early as 1915, the Investment Bankers Association informed its members that they could prevent blue skies legislations by making securities offerings across state lines through the mail. Today the SEC brings various civil enforcement actions against companies and people that breach securities legislations annually.

A private equity had administration can make those hard choices for longer-term development without the continuous scrutiny of investment experts, quarterly reports and the media. They do not need to contend with the same government regulations, such as Sarbanes-Oxley, as public companies. Ultimately, there is troubled financial debt, an unique circumstance within private equity that refers to investing in the financial obligation of a company that has major monetary troubles. This can require a “distressed-to-control” method, where the private equity firm acquires the debt of a distressed firm in the hopes of taking control when the firm arises from restructuring.

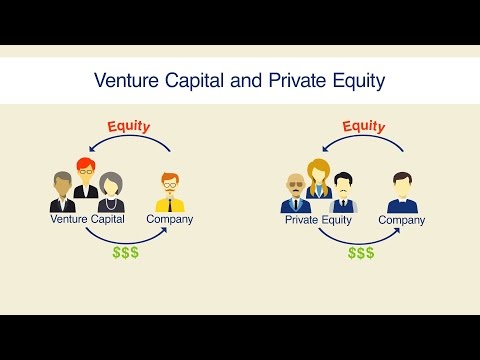

After three to 7 years of possession and also dealing with the business, the fund supervisor will look for to “leave” the business by taking business public or offering it for a greater assessment than it was purchased. This leave distributes profits from the sale (” returns”) to the capitalists in the fund and the fund manager. At the end of this process, private equity financial investments typically cause better work, stronger companies, and healthier areas. The emergence of public business taking on private equity on the market to purchase, change, and sell businesses could profit capitalists considerably. Private equity funds are illiquid and also are high-risk because of their high use financial debt; additionally, once capitalists have turned their money over to the fund, they have no say in just how it`s handled. In payment for these terms, capitalists need to anticipate a high rate of return.

There is no warranty whether expressed or suggested that real cash flow of any specific private equity fund will follow this pattern. Investments in private equity include a substantial level of threat, there is no warranty that any investment in a Pomona-sponsored fund will inevitably pay as well as an investor can lose some or all of its investment. A private equity firm commonly handles several definitely various funds, and will try to raise money for a brand-new fund every 3 to 5 years, as the cash from the previous fund is invested. An angel capitalist is an individual or firm that provides capital for start-up services for possession equity or convertible financial obligation.

The private equity market infuses a considerable quantity of resources into the U.S. economic situation. Because 2013, private equity funds have invested over $400 billion every year in tens of hundreds of American business in a variety of states and also neighborhoods. The Cambridge Associates U.S. Private Equity Indexis based on quarterly performance data assembled from 1,486 US private equity funds, consisting of fully sold off partnerships, developed between 1986 and also 2018. The index has limitations and can not be utilized to forecast performance of the Fund. These constraints include survivorship bias; heterogeneity; as well as restricted information. The index has actually not been selected to represent an ideal benchmark to contrast an investor`s performance, but rather is provided to allow for comparison to that of specific well-known as well as extensively acknowledged indices. See Cambridge Associates for a total description on IRR computations and also presumptions.

Over the years,Tyler Tysdal has been an owner and managing partner of private equity and venture capital firms, and has worked as an entrepreneur raising capital for his own companies at times. He started his career in investment banking working on Initial Public Offerings (IPO`s) and mergers and acquisitions.Tyler T. Tysdal has actually dealt with the buy-side, the sell-side and as an agent in deals for companies ranging from $100,000 to greater than $1 billion. As an investor, Ty has handled assets and economically backed multiple other business owners. He`s taken care of or co-managed about $1.7 billion for ultra-wealthy families and has assisted produce hundreds of millions in wealth for his private equity investors.

Entry-level positions can need a bachelor`s level, while MBAs can typically begin their career at the associate level in an investment firm. When you`re initial getting going, you usually handle the title of expert. Because this is a beginner setting, you may get stuck doing the majority of the dirty work. It`s not likely that “obtaining coffee” will certainly be in your work description, but it might belong of your day-to-day routine. If you are describing top investment banks as measured by bargain volume or resources elevated then you require to gain access to organization tables, as well as even organization tables are infamously sliced and diced by investment banks to make themselves look bigger. State a firm intends to obtain cash to build a factory or employ even more employees or whatever.